Establishment of Companies in Greece

You have decided to establish a subsidiary in Greece and you are searching for the right firm that will undertake on your behalf the overall procedure for its establishment and operation in Greece.

A difficult decision since apart from the economic cost, there is the question of whether the candidate office is suitable, whether it meets the conditions for you to place your trust in it, and if so, whether it can offer high added value services.

Another matter is whether this office is organized as a one stop supplier, providing accounting, taxation, legal, registered office services, notary services, etc.

The experience, abilities and reliability of E.F.M.’s consultants will meet even your highest standards, offering a sense of security in the launching of your investment in Greece from the first minute you contact us, and all this at a perfectly reasonable cost

We can provide integrated services for a broad range of business activities.

So it is not by chance that our clientele includes customers with global presence in all five continents, in Commercial, Industrial, Pharmaceutical, Service provision fields, etc.

Company Formation in Greece

ESTABLISHMENT – INCORPORATION OF A COMPANY IN GREECE

The procedure for the registration of a Greek Company is quite simple and fast, since only a few documents and a maximum of 20-25 days are required for the company’s registration, and most importantly, you do NOT need to visit Greece, since we take care of the entire procedure.

A. Establishment of a Limited Liability Company. An ordinary form of company in Greece:

11 Steps for commencing a business activity in Greece

The Limited Liability Company form is frequently chosen in Greece when establishing a subsidiary company. In this case the foreign parent company usually appears as a shareholder.

The partners of E.F.M. will assist you in all matters for the creation of a limited liability company in Greece.

Finding work space for purchase or rental.

Finding and hiring staff.

Guidance for the supply of all necessary equipment for the operation of your company.

Guidance and advice on the following:

Keeping company books

Monthly monitoring of accounting matters.

Computerization

If you do not require a physical registered office in Greece, we can host your company in our offices.

Virtual personal secretary

Professional address, Fax line

Telephone line that can be answered in the name of your company.

Acceptance and forwarding of mail

Email service

Fully furnished and equipped office

Our legal department undertakes your support on an ongoing basis.

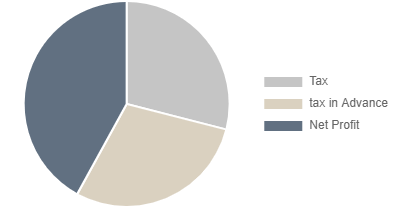

Example

Consider that the company ALFA & BETA IKE presented net pre-tax profit for the year 2021 € 100.000,00. What will be the tax that will result in each case and what would be the cash advance.

Answer

The corporation tax for the year 2021 is calculated as follows:

100.000,00 x 24% = 24,000.00 (which will be paid either as a single tax return filing, or in eight (8) installments, with the first being paid upon filing the filing and the rest up to last working day of each following month).

In addition, 5% dividend tax will be paid so, 100,000.00 x 5% = 5.000.00 (which should be paid as a lump sum within the next month from the one withholding)

Establishment companies LLC, Ltd, SA

Β. PPC establishment

Private Capital Company

Step 1: Check if it is required any special professional license.

Step 2: Registry address.

Step 3: Articles of association.

Step 4: Collection of required documents upon each case

Step 5: Pre-registration at O.A.E.E (social security fund)

Step 6: Submission of documents at the Commercial registry at one stop services

Private Capital Company (called IKE) is a new form of company introduced by N.4072 / 2012. Private Capital Company is a limited liability company.

The profit of a Private Capital Company is taxed by the income tax rate of 29% whereas its dividends are taxed with 10%. The tax advance for the next year is 100%.

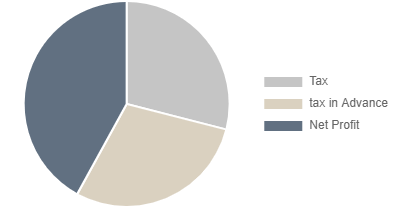

Example

Consider that the company ALFA & BETA PPC presented net pre-tax profit for the year 2021 € 100.000,00. What will be the tax that will result in each case and what would be the cash advance.

Answer

The corporation tax for the year 2019 is calculated as follows:

100.000,00 x 24% = 24,000.00 (which will be paid either as a single tax return filing, or in eight (8) installments, with the first being paid upon filing the filing and the rest up to last working day of each following month).

In addition, 5% dividend tax will be paid so, 100,000.00 x 5% = 5.000.00 (which should be paid as a lump sum within the next month from the one withholding)

Download our brochure about Establishment of a Company in Greece